Tax Preparation Strategies

While the estate tax has almost disappeared in recent years, income taxes still consumes a large part of the last dollars of high-income earners.

Many clients who exercise any variety of stock options or sell a business now see almost 50% of those gains lost to state and local taxes. Most executives with high levels of W-2 income do not know this can be prevented by using time-tested tax avoidance strategies. These strategies have been a permanent part of the tax code since 1969.

We are privileged to hold the Enrolled Agent designation to be able to represent taxpayers before the IRS. We specialize in helping clients implement these proven tax preparation strategies that can reduce taxes up to 50% and create a powerful income stream for their retirement years.

New Tax Return Online Document Management

We moved to a cloud-based customer environment that allows all our clients to upload their tax documents to a secure server and access those documents 24/7 as well.

John L. Mills EA

Enrolled Agent licensed to practice before the Internal Revenue Service

Professional Tax Preparation

So, what is tax planning? It’s simple. Tax preparation is viewing activities that generate tax liability by driving your car and looking through the rear view mirror asking what happened last year or in previous years?

Tax planning is fundamentally different. It is like driving your car looking through the windshield. Because the future is unknown it requires more thought and effort but is more rewarding because it allows you to execute strategies that will minimize taxes over many years in the future.

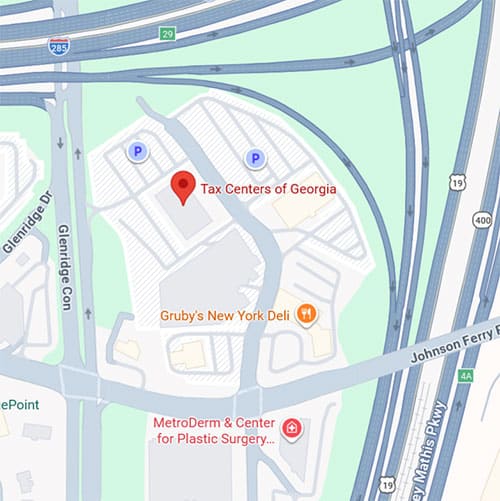

Tax Centers of Georgia participates in United Cloud Partners Services tax preparation network as well as using its own staff of IRS enrolled agents