401k Retirement Plan

Make your 401k Plan a competitive advantage attracting and retaining top talent in your industry with the new PEP 401k retirement plan.

A New Approach To A 401k Retirement Plan

We provide a personal evaluation and assistance with implementing a new type of 401k retirement plan called PEP, Pooled Employer Plan. We can do this by connecting you with the industry’s leading provider, Empower, the largest retirement services company in the country.

Our goal is for the employer’s overall cost to be as low as possible, thus helping to create the potential for higher profits in your business.

About John Mills

We have worked with businesses, and we’ve seen how this new PEP has helped employers and employees. With a background in Tax Preparation and Estate Planning, we can, along with Michael, the PEP plan expert, help you transition your business.

Paycheck Protection Program

• Overall plan operational compliance

• IRS Form 5500 signed by your new PPP

• Annual plan audits at no additional cost

• New hire processing

• Participant call center

• Mandatory interim reinstatements

• Recordkeeper emails come to us

• Annual plan notices

• Document compliance

• Participant fee disclosures

• Distributions

• Employee separations & rollovers

• Limitations calculations

• Prudent monitoring & selection of providers

Empower Payroll Integration

An intricate part of running your retirement plan is offering 180 & 360 integration to over 260 payroll providers, including built-in eligibility rules, contribution changes, auto-enrollment, and advisor new-hire notifications for a better experience.

Your Employees Can

• Enroll in 37 seconds

• Mobile app access

• Retirement planning 24/7

• View projected retirement

• Adjust contributions

• Rebalance portfolios

• Active management allocation models

Wealth Management and Retirement Plan Fiduciary Services

Ms. Reeves is the Managing Director of Bell Rock Capital, LLC.

• Benchmarked and reviewed at least quarterly

• Our Investment line-up consists of 41 funds designed to provide targeted sectors when needed.

• Avg. investment expense – 0.24%

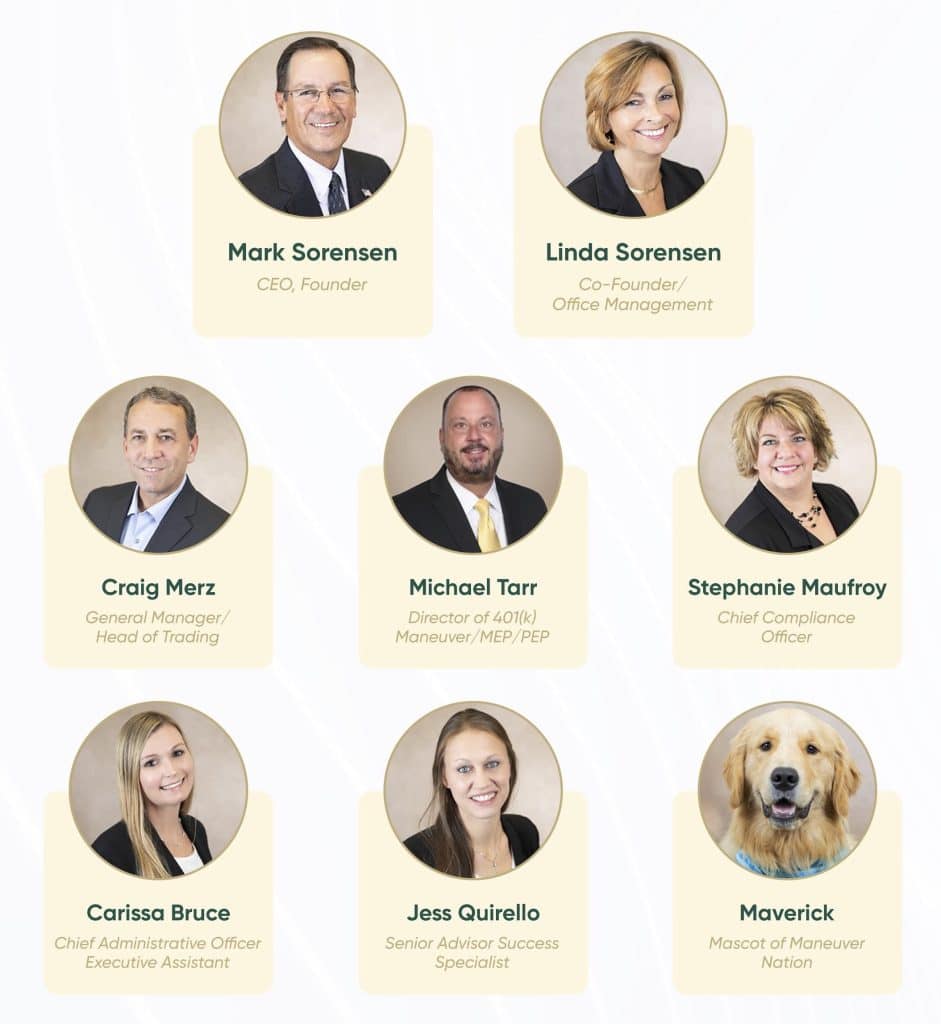

The Team

About Us

Royal Fund Management was opened in 2007 by Mr. & Mrs. Mark and Linda Sorensen. Domiciled in Lady Lake, Florida, our “Client First” mission statement catapulted us to be what we think is one of America’s top boutique Fee-Only SEC Registered Investment Advisory firms.

When we see a need, we build what we think is the best product offering that suits clients for either their short or long-term goals.

We certainly don’t believe in “set it and forget it” for any investment advice. We are an investment advisory firm, and that’s what we do, give advice.

We try to be in what is working and out of what is not working.

By meeting a desperate need for our clients, word of mouth grew, and our advisors started presenting 401(k) Maneuver. Suddenly, we were actively managing retirement accounts in over 470 companies.

Think of it like having the best house in the best neighborhood at the best price. This is why we built our 401(k) Maneuver PEP (Pooled Employer Plan).

At Tax Centers of Georgia, we know that you want to go from difficult to manage and expensive 401k retirement plan to a simple 401k retirement plan.

In order to do that, you need a 401k retirement plan partner.

The problem is employers don’t realize their potential liability as the sponsor for managing employee 401k plans.

…Employers don’t realize they can transfer their liability to third parties.

We understand that you want to do the right thing but don’t know how, which is why John Mills and his team can help you transition your business for the better.

Here’s how we do it:

1) Book A 401K Appointment

2) Transfer the Liability

3) Reduce Annual Plan Audit Costs

What is a 401k and how does it work?

Is 401k all your money?

Does a 401k invest your money?

A 401(k) plan will typically offer a range of investments, but any single plan may not offer all possible types of investments. The most common investment options include: Stock mutual funds: These funds invest in stocks and may have specific themes, such as value stocks or dividend stocks.

Do you lose your 401k match if you quit?

Is 401k better than just investing?

401k Retirement Planning

Stop worrying about your employee’s future and instead, rest easy knowing you have helped to get your employee 401k retirement plan right.